The Price is Right—But Is It?

Inflation is like that uninvited guest who shows up at your dinner party and gobbles down all the hors d’oeuvres. One moment, your dollar feels robust; the next, it’s gasping for air, trying to keep up with rising prices. This economic phenomenon affects everything from your morning coffee to your evening Netflix binge. Understanding inflation is crucial because it directly impacts your wallet, your savings, and ultimately, your lifestyle.

Picture this: you’re at the grocery store, armed with a shopping list. You waltz down the aisles, confident and ready. You pick up a carton of eggs, and suddenly, you’re slapped with a price tag that looks more like a mortgage payment than a breakfast item. What’s going on? As prices inflate like a balloon at a birthday party, it’s essential to understand the underlying causes to prevent that dreaded sticker shock.

What is Inflation, Anyway? A Quick Overview

Inflation, at its core, is the rate at which the general level of prices for goods and services rises, causing purchasing power to fall. Simply put, as inflation climbs, each dollar buys less. This can be quite a nuisance for your finances.

Types of Inflation: Demand-Pull vs. Cost-Push (and What That Means for You)

Inflation isn’t a one-size-fits-all scenario; it comes in various flavors. The two primary types are demand-pull and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds their supply. Think of it as a game of musical chairs🏛️there just aren’t enough seats for everyone wanting to buy.

On the flip side, cost-push inflation happens when the costs of production increase, leading to a rise in prices. It’s like trying to buy a hot dog at a baseball game; if the price of hot dog buns skyrockets, you can bet your mustard that the hot dog’s price will follow suit.

Measuring Inflation: The Consumer Price Index (CPI) and Other Key Indicators

To gauge how inflation is changing, economists use various measures, with the Consumer Price Index (CPI) being the most popular. The CPI tracks the average change over time in the prices paid by consumers for a basket of goods and services. It’s as if someone took a shopping cart filled with everything you buy and monitored its cost over time. If that cart’s price keeps climbing, you know inflation is in full swing.

Cause 🏛️1: Demand-Pull Inflation: Too Many Dollars, Not Enough Cabbages

Demand-pull inflation is the economic equivalent of a kid in a candy store🏛️everyone wants a piece, but there aren’t enough goodies to go around. When people have more money to spend, they go wild, driving up demand. The mechanics of this inflation type are straightforward: when demand exceeds supply, prices soar.

Examples of When Demand Outstrips Supply (Spoiler Alert: Think Toilet Paper)

Remember those early pandemic days when toilet paper became a luxury item? Demand surged as everyone rushed to stockpile supplies, leaving store shelves bare. That classic case of demand-pull inflation turned the humble toilet paper roll into a coveted treasure! This scenario illustrates how collective behavior can lead to inflated prices.

How Consumer Behavior Influences Demand and Prices

Consumer behavior significantly influences demand and, consequently, prices. Emotional spending, trends, and even viral social media challenges can lead to sudden spikes in demand. When consumers feel optimistic about the economy, they spend more, further fueling demand-pull inflation. It’s a cycle that can leave your wallet feeling quite deflated!

Cause 🏛️2: Cost-Push Inflation: The Price of Everything Goes Up Except Your Salary

Cost-push inflation is the dark cloud looming over your financial forecast. This phenomenon occurs when the cost of production rises, forcing producers to pass those costs onto consumers. Think of it as the unwelcome increase in your monthly expenses when your favorite pizza delivery guy raises prices🏛️not cool!

What Is Cost-Push Inflation and How Does It Work?

Cost-push inflation stems from rising costs of materials and labor, leading to decreased supply. If it costs more to produce a product, the price consumers pay will inevitably rise. It’s as if your favorite dish at a restaurant is suddenly on the “premium” menu due to ingredient shortages.

Factors Contributing to Rising Production Costs (Hint: It’s Not Just the Pizza Delivery Guy)

Numerous factors can contribute to rising production costs. For instance, if oil prices spike, transportation costs for goods increase, making everything from groceries to gadgets more expensive. Weather-related disruptions, geopolitical tensions, and labor strikes can also contribute to this inflation type, sending shockwaves through the economy.🏛️

Real-World Examples: The Impact of Rising Oil Prices on Everyday Goods

Take, for example, the rise in oil prices. As crude oil costs increase, so do transportation costs. This hike in prices cascades down the supply chain, inflating the costs of everyday goods. That gallon of milk you bought last week suddenly feels like a luxury item when oil prices soar!

Cause 🏛️3: Built-In Inflation: Wage Spirals and the Cost of Living

Built-in inflation, often a result of rising wages, creates a self-perpetuating cycle. As employees demand higher wages to keep up with increasing living costs, businesses may raise prices to maintain their profit margins.

What Is Built-In Inflation and How Does It Affect Your Paycheck?

Built-in inflation is the type that sneaks up on you. It’s based on the assumption that prices will keep rising, leading employees to negotiate higher salaries. As wages increase, purchasing power might seem to get a boost. However, if prices rise even faster, workers find themselves in a financial treadmill🏛️running hard but getting nowhere.

The Role of Labor Unions and Collective Bargaining in Inflation

Labor unions play a pivotal role in built-in inflation, often advocating for better wages and working conditions. While this can benefit workers, it can also lead businesses to increase prices to cover these wage hikes. This cyclical dance between wages and prices can create a precarious balance.

Examples of How Wage Increases Can Lead to Higher Prices

When large companies raise salaries, they often pass on these costs to consumers. For example, if a fast-food chain increases its workers’ wages, don’t be surprised to see a rise in the price of your favorite burger combo. Suddenly, that delicious meal doesn’t seem so inexpensive anymore!🏛️

Cause 🏛️4: Monetary Policy: When the Central Bank Plays with Fire

Monetary policy is like a chef adjusting the heat on the stove. Central banks manage inflation by controlling the money supply and interest rates, trying to maintain a delicate balance.

Understanding Monetary Policy and Its Influence on Inflation

Central banks, such as the Federal Reserve in the U.S., use monetary policy to influence economic activity. They can either stimulate growth or curb inflation through adjustments in interest rates and the money supply.

The Role of Interest Rates in Controlling Inflation (or Not)

When interest rates rise, borrowing becomes more expensive. This can cool consumer spending and business investment, potentially reducing inflation. Conversely, lowering rates encourages spending and investment, which can ignite inflationary pressures. It’s a fine line to walk🏛️too much heat, and things can boil over.

How Money Supply Affects Inflation: More Money, More Problems?

If the central bank increases the money supply too rapidly, it can lead to inflation. Imagine a bakery suddenly printing more money to buy ingredients; it sounds great until those cookies start costing an arm and a leg! More money chasing the same amount of goods leads to price increases, resulting in what many call “too much of a good thing.”

Cause 🏛️5: Supply Chain Disruptions: The Domino Effect

Supply chain disruptions are the wild card in the inflation game. A hiccup anywhere along the supply chain can lead to cascading effects, causing prices to rise unexpectedly.

How Global Events Can Cause Supply Chain Issues and Fuel Inflation

Global events, such as pandemics, natural disasters, or geopolitical tensions, can severely impact supply chains. When factories close or shipping routes are disrupted, the flow of goods is affected, leading to shortages and price hikes. It’s like trying to play Jenga while someone keeps pulling out blocks!

Examples of Recent Disruptions (Thank You, Pandemic and Shipping Delays)

The COVID-19 pandemic serves as a prime example of supply chain disruptions. Lockdowns led to factory closures and shipping delays, creating a perfect storm for inflation. Goods became scarce, prices soared, and the “everything shortage” became the new normal.🏛️

The Ripple Effect: From Factory to Your Shopping Cart

From raw materials to finished products, disruptions create a ripple effect that touches every consumer. When manufacturers face delays or increased costs, those burdens often trickle down to your shopping cart. Suddenly, you find yourself paying more for essentials, all thanks to a disruption thousands of miles away.

Inflation Expectations: The Psychology of Prices

The psychology behind inflation is fascinating. Consumer expectations play a significant role in driving inflation. If people believe prices will continue to rise, they may spend more now, exacerbating the problem.🏛️

How Consumer Expectations Can Drive Inflation

If consumers expect prices to rise, they might rush to buy now, creating a surge in demand. This behavior can lead to a self-fulfilling prophecy, pushing prices up even further. It’s a classic case of “the more you worry, the worse it gets.”

The Role of News Media in Shaping Public Perception of Inflation

News media also play a crucial role in shaping public perception of inflation. Headlines about rising prices can create panic, leading consumers to alter their spending habits. Sensationalism in reporting can contribute to a psychological cycle that fuels inflation expectations.

Why “Expectations” Can Sometimes Become Self-Fulfilling Prophecies

When consumers start to expect higher prices, their behavior changes accordingly. This can create a feedback loop where expectations drive actual inflation, leading to an economic phenomenon that can spiral out of control. It’s a classic case of what goes around, comes around!🏛️

The Interplay of Causes: How They Work Together

Understanding inflation requires looking beyond individual causes to see how they interconnect. The causes of inflation often overlap, creating a complex web that can leave policymakers scratching their heads.

Exploring the Interconnectedness of the Five Causes of Inflation

Demand-pull and cost-push inflation can happen simultaneously, creating a perfect storm for rising prices. For instance, if demand surges during an economic boom but production costs also rise due to supply chain issues, the result is a double whammy for consumers.🏛️

Real-Life Scenarios Where Multiple Causes Collide

Imagine a scenario where a natural disaster disrupts oil supplies, raising transportation costs. Meanwhile, consumer demand skyrockets as people rush to stock up on essentials. This intersection of causes can lead to sharp price increases, showcasing the intricate dance of inflation.

Why It’s Crucial to Look at the Big Picture

To truly grasp inflation, one must consider the entire economic landscape. The interplay of various factors, including consumer behavior, production costs, and monetary policy, creates a multifaceted issue that demands attention. Ignoring one element can lead to an incomplete understanding and ineffective responses.🏛️

The Effects of Inflation: It’s Not All Bad (But Mostly It Is)

While inflation is often viewed as a villain in the financial narrative, it can have both positive and negative effects.

Positive Effects of Mild Inflation: A Sign of Economic Growth?

Mild inflation can signal a growing economy. When prices rise gradually, it often indicates increased demand, leading to higher production levels and employment rates. It’s like a gentle nudge that encourages spending and investment.

Negative Effects: How Inflation Erodes Purchasing Power

However, rampant inflation can be detrimental, eroding purchasing power. When prices rise faster than wages, consumers find themselves in a bind. Suddenly, that paycheck doesn’t stretch as far as it used to, making it challenging to maintain the same lifestyle.🏛️

Inflation’s Impact on Savings and Investments

Inflation can also impact savings and investments. If the inflation rate exceeds the interest earned on savings accounts, the real value of your savings diminishes. In other words, if you’re not earning enough on your investments to outpace inflation, you could be losing money in the long run.

Historical Perspectives: Learning from the Past

History provides valuable insights into inflationary trends and the factors that drive them.

A Brief History of Inflation in Different Countries

Inflation isn’t a new phenomenon; it has existed for centuries. Various countries have faced different inflationary pressures, resulting in unique economic outcomes. From post-war Germany’s hyperinflation to modern-day Venezuela, understanding these historical contexts can shed light on current inflation challenges.🏛️

Lessons Learned from Hyperinflation: The Case of Zimbabwe

Zimbabwe’s hyperinflation episode is a cautionary tale for policymakers. At its peak, the inflation rate soared into the billions, rendering the currency virtually worthless. The lessons from such experiences highlight the need for sound monetary policy and economic stability.

How History Can Inform Current Inflation Trends

Historical trends can inform current inflationary pressures, providing insights into potential outcomes. By examining past events, economists can better anticipate and mitigate the effects of inflation, helping to avoid catastrophic scenarios.

Combating Inflation: Tips for the Everyday Consumer

While inflation may seem insurmountable, there are practical steps consumers can take to protect their wallets.

Practical Tips for Protecting Your Wallet Against Inflation

To shield yourself from the inflation monster, consider diversifying your spending. Buy in bulk, seek discounts, and adjust your budget to prioritize essential items. Small adjustments can lead to significant savings over time.🏛️

Budgeting Strategies in an Inflationary Environment

Creating a flexible budget is crucial in an inflationary environment. Regularly review your spending habits and adjust accordingly. Consider setting aside extra funds for unforeseen price increases to stay ahead of the curve.

Investing in Assets That Typically Outpace Inflation

When it comes to investing, consider assets that historically outpace inflation, such as real estate or stocks. These investments can provide a hedge against rising prices, allowing your money to grow even when inflation threatens to undermine its value.

Government Responses: What Can Be Done?

Governments play a crucial role in managing inflation and can implement various measures to mitigate its effects.

Overview of Government Measures to Control Inflation

Governments can employ several strategies to combat inflation, including adjusting tax policies, regulating prices, or controlling the money supply. These measures can help stabilize the economy and protect consumers from soaring prices.

The Role of Fiscal Policy in Combating Rising Prices

Fiscal policy, which involves government spending and taxation, can significantly impact inflation. By adjusting these levers, governments can stimulate or cool down economic activity, helping to maintain price stability.🏛️

Central Banks and Their Inflation-Fighting Tools

Central banks wield powerful tools to combat inflation, including interest rate adjustments and open market operations. By influencing money supply and credit availability, these institutions play a vital role in maintaining economic equilibrium.

The Future of Inflation: What Lies Ahead?

As the economic landscape evolves, so too do inflationary pressures.

Current Trends That May Shape Future Inflation

Several factors, including technological advancements, globalization, and changing consumer behaviors, could influence future inflation trends. Staying informed about these trends can help individuals and businesses prepare for potential challenges.

Predictions from Economists: Should We Be Worried?

Economists offer varied predictions regarding future inflation rates. Some foresee a return to stability, while others caution about the potential for rising prices. Understanding these perspectives can help individuals navigate their financial futures.🏛️

How Technological Advancements Might Influence Inflation

Technological advancements can both mitigate and exacerbate inflation. Innovations in supply chain management and production efficiency can help control costs, while rapid advancements may create new demand and push prices higher.

Conclusion: Keeping Your Wallet Safe in the Inflation Game

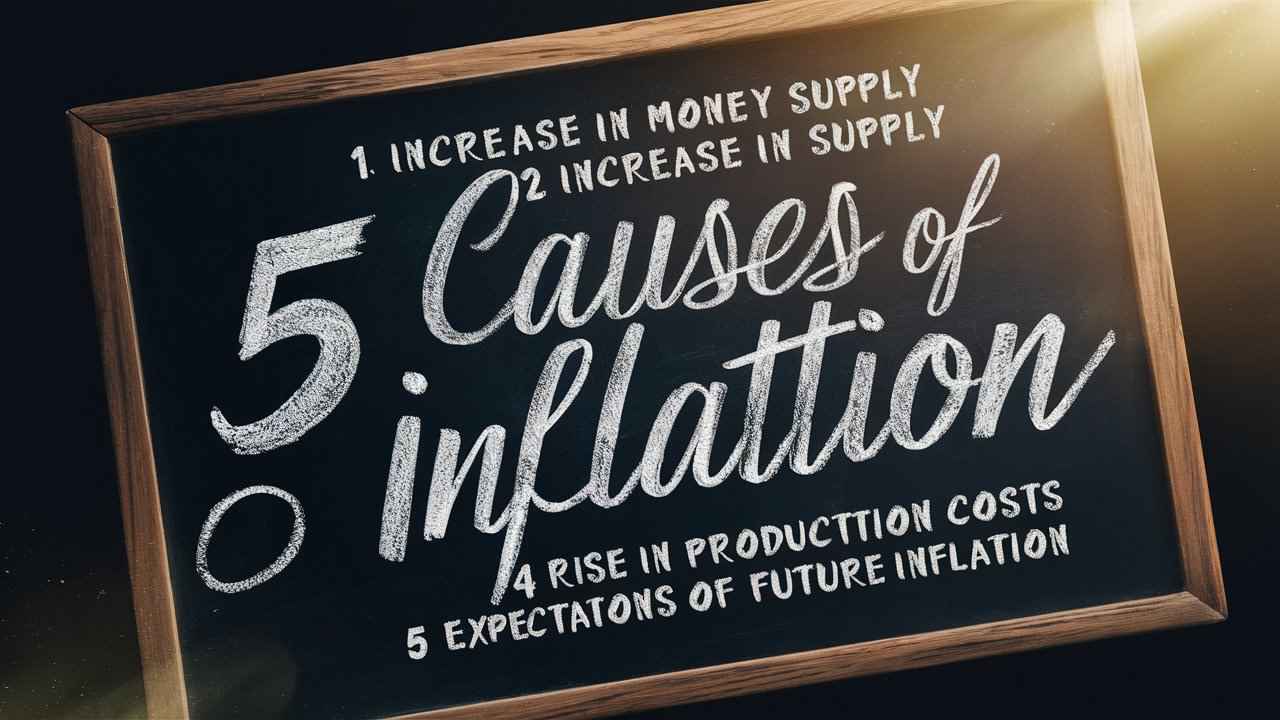

Inflation, while often perceived as an economic adversary, is a complex and multifaceted issue. Understanding the five causes of inflation🏛️demand-pull, cost-push, built-in, monetary policy, and supply chain disruptions🏛️can equip consumers to make informed financial decisions.

Staying proactive in monitoring economic trends and adjusting personal finances accordingly is crucial. By understanding inflation’s mechanics and its potential impact, individuals can better navigate the financial rollercoaster, ensuring their wallets remain as healthy as possible in these unpredictable times.

People Also Ask

What is Causing US Inflation?

US inflation is driven by several interconnected factors. Currently, one major cause is the surge in consumer demand following the pandemic, where increased spending has outstripped supply. Additionally, disruptions in global supply chains have contributed to shortages and increased prices for essential goods. Rising energy prices, labor shortages, and escalating production costs further exacerbate the inflationary pressures.

What is Inflation Types and Causes?

Inflation can be broadly categorized into various types based on its causes and characteristics:

Demand-Pull Inflation

This occurs when demand for goods and services exceeds supply, leading to price increases. Factors include increased consumer spending, government expenditure, and economic growth.

Cost-Push Inflation

This type arises when the costs of production increase, prompting businesses to raise prices. Key contributors include rising wages and raw material costs.

Built-In Inflation

Often related to wage-price spirals, built-in inflation occurs when businesses raise prices to cover increased wage costs, leading to further wage demands.

What are the Causes of Inflation PDF?

While there isn’t a specific PDF that lists the causes of inflation, many economic studies and government reports detail them. Typically, these include:

- Demand-pull factors

- Cost-push factors

- Monetary policy influences

- Expectations of future inflation

- Supply chain disruptions

What are the 5 Types of Inflation?

The five common types of inflation include:

- Demand-Pull Inflation: Resulting from increased consumer demand.

- Cost-Push Inflation: Driven by rising production costs.

- Built-In Inflation: Related to wage increases and cost of living adjustments.

- Hyperinflation: Extremely high and typically accelerating inflation, often exceeding 50% per month.

- Stagflation: A combination of stagnant economic growth, high unemployment, and high inflation.

What are the 5 Speeds of Inflation?

The five speeds of inflation generally refer to the rate at which inflation is rising:

- Creeping Inflation: Low, manageable inflation (1-3%).

- Walking Inflation: Moderate inflation (3-10%) that can begin to raise concerns.

- Galloping Inflation: Rapid inflation (10-20%) that can significantly impact purchasing power.

- Hyperinflation: Extreme inflation rates (over 50% per month), leading to a currency crisis.

- Deflation: While technically not a type of inflation, deflation refers to a decrease in the general price level of goods and services.

How to Stop Inflation?

To combat inflation, policymakers can implement several strategies:

- Monetary Policy Adjustments: Raising interest rates to reduce money supply and slow down spending.

- Fiscal Policy Changes: Reducing government spending and increasing taxes to cool off the economy.

- Supply Chain Improvements: Investing in infrastructure to enhance production and distribution efficiency.

- Encouraging Productivity: Promoting technologies and practices that improve productivity and reduce costs.

What are the 3 Types of Problems Caused by Inflation?

Inflation can lead to several economic problems:

Erosion of Purchasing Power

As prices rise, the value of money diminishes, making it harder for consumers to afford goods and services.

Uncertainty in Economic Planning

Inflation creates unpredictability in future costs, making it difficult for businesses and consumers to plan budgets.

Income Redistribution

Inflation can disproportionately affect lower-income households that spend a larger percentage of their income on necessities, leading to greater inequality.

Which of These Causes Inflation?

Inflation can arise from various causes, including:

- Increased consumer demand

- Rising production costs

- Expansionary monetary policy

- Supply chain disruptions

- Inflationary expectations

Is Inflation Good or Bad?

Inflation has both positive and negative effects:

- Good Aspects: Moderate inflation can stimulate spending and investment. It can indicate a growing economy and encourage consumers to make purchases sooner rather than later.

- Bad Aspects: High inflation erodes purchasing power, creates uncertainty, and can lead to economic instability, affecting savings and investments.

Who Benefits from Inflation?

Some entities may benefit from inflation, including:

- Borrowers: They can repay loans with money that is worth less than when they borrowed it.

- Investors in Assets: Real estate and commodities often appreciate in value during inflationary periods.

- Businesses with Pricing Power: Companies that can pass on costs to consumers may maintain or increase profit margins.

What are the Seven Causes of Inflation?

The seven common causes of inflation include:

- Demand-Pull Factors

- Cost-Push Factors

- Built-In Inflation

- Monetary Expansion

- Supply Chain Disruptions

- Government Policy Changes

- Consumer Expectations

Why Do We Need Inflation?

Moderate inflation is considered necessary for a healthy economy:

- Encourages Spending: People are more likely to spend now rather than save if they expect prices to rise.

- Stimulates Economic Growth: It can promote production and investment, contributing to overall economic growth.

- Wage Adjustments: Inflation allows for nominal wage increases, which can help workers keep up with the rising cost of living.

What are the Five Negative Effects of Inflation?

The five negative effects of inflation include:

- Decreased Purchasing Power: Consumers can buy less with the same amount of money.

- Increased Cost of Living: Essential goods and services become more expensive.

- Uncertainty and Instability: High inflation can lead to economic volatility.

- Impact on Savings: Real interest rates may turn negative, eroding savings.

- Wealth Redistribution: It can unfairly affect those on fixed incomes and widen economic inequality.

What is Causing Inflation?

Currently, inflation is primarily caused by:

- Increased consumer demand post-pandemic

- Supply chain disruptions

- Rising production and labor costs

- Energy price spikes

Who Controls Inflation?

Inflation is primarily controlled by central banks, such as the Federal Reserve in the United States, through monetary policy. They can adjust interest rates and manage money supply to influence inflation levels.

What Causes Deflation?

Deflation occurs when the general price level of goods and services declines, often due to:

- Decreased consumer demand

- Increased productivity or technological advancements leading to oversupply

- Contraction of the money supply

- Economic recession or downturns that reduce spending and investment