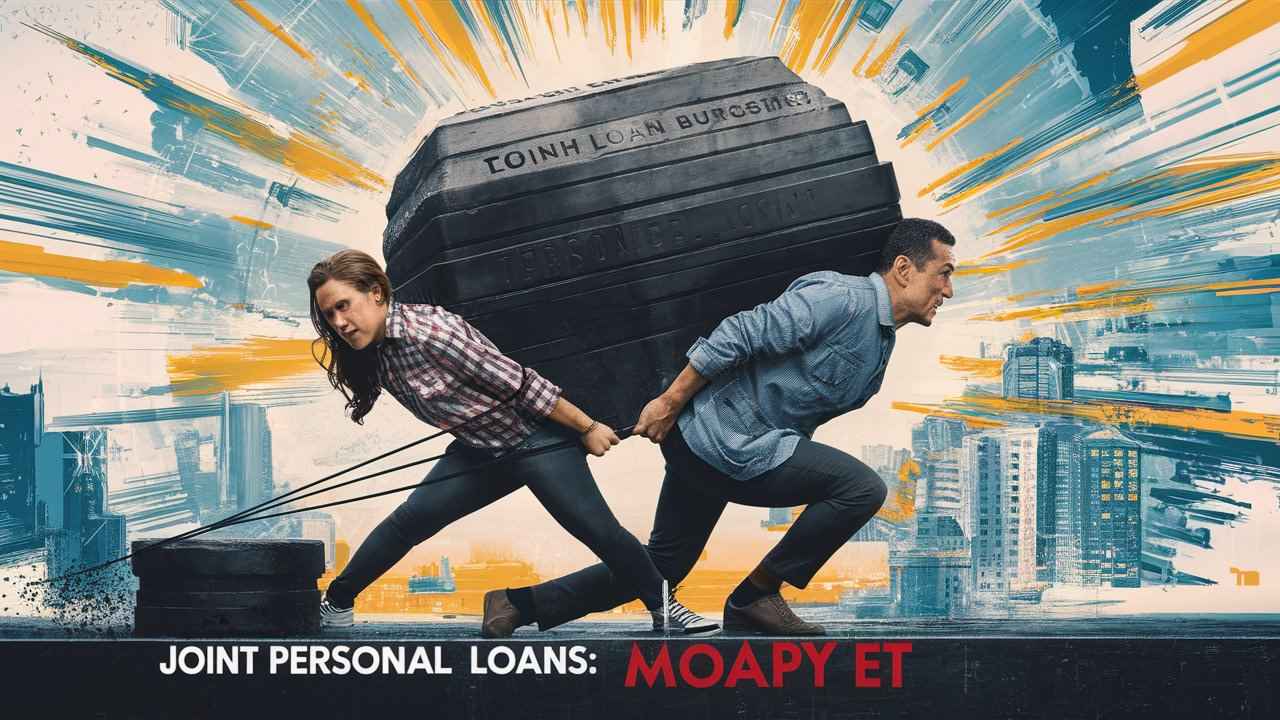

Why Go Solo When You Can Team Up?

When it comes to major financial goals, the lone wolf approach isn’t always the best bet. A Joint Personal Loan can help you reach new heights financially and is the ultimate power move for partners who want to pool their resources. Whether you’re sharing the load with a spouse, a friend, or even a business partner, joint loans provide unique advantages that make the path to financial success a whole lot smoother.

Understanding Joint Personal Loans

The Basics: What Is a Joint Personal Loan?

A Joint Personal Loan allows two people to borrow money together, combining their income, credit scores, and other financial profiles to strengthen their application. Both parties share responsibility for repayment, making this an ideal option for those who want to tackle big purchases or consolidate debts together.

How Joint Loans Differ from Individual Loans

Unlike a solo loan, a joint loan includes two names on the dotted line. Both borrowers’ incomes and credit scores factor into the lender’s decision, often making it easier to qualify or get a better interest rate than you might as a single applicant. However, both borrowers are equally responsible for the debt, which can have its perks💲and pitfalls.

When a Joint Loan Makes Sense: Key Scenarios

Joint loans can be a great option in certain scenarios: couples planning a wedding, partners embarking on a major home renovation, or friends pooling funds to start a business. These shared goals make Joint Personal Loans a natural fit when both parties are committed to the cause.💲

The Perks of Partnership: Why People Choose Joint Loans

By sharing both the debt and the repayment responsibility, joint loans can offer access to larger sums, better interest rates, and a stronger credit boost💲provided payments are made on time, of course!

Advantages of Joint Personal Loans

Double the Income, Double the Borrowing Power

With two incomes at play, lenders often grant access to larger loan amounts, which is a huge advantage when funding big-ticket items or ambitious ventures.

A Shared Load: Splitting Repayment Responsibilities

One of the key benefits of Joint Personal Loans is the ability to divide the monthly payments. This makes larger loans more manageable and spreads the responsibility evenly.💲

Better Rates, Better Terms: How Two Incomes Can Help

With two income sources and potentially a better combined credit score, you’re more likely to snag favorable loan terms, like lower interest rates and more flexible repayment options.

Building Credit Together: A Boost for Both Parties

Joint loans offer a way to build or improve credit as a team. Consistent, on-time payments can positively affect both credit scores, providing long-term benefits.💲

Potential Pitfalls of Joint Loans

Shared Debt, Shared Responsibility: What Happens if One Defaults?

In a joint loan, both borrowers are equally liable. If one person defaults or misses a payment, it impacts both parties. This underscores the need for a solid, mutual understanding of the repayment plan.

Navigating Disagreements: Financial Stress in Partnerships

Money is a major source of stress in any partnership. Differences in spending habits, unexpected expenses, or job changes can all cause tension if not addressed upfront.💲

Impact on Personal Credit Scores: The Good, Bad, and Ugly

While joint loans can be a credit-building tool, any late or missed payments affect both borrowers’ credit scores. It’s a double-edged sword that needs to be handled with care.

Legal Implications: Who Owns the Debt if Things Go South?

Debt is still owed by both parties if the relationship ends. In the event of separation, divorce, or other partnership dissolution, both are still legally obligated to pay off the loan unless refinanced or otherwise resolved.💲

Who Should Consider a Joint Personal Loan?

Couples Moving Toward Big Goals

Joint loans make sense for couples planning for major purchases, such as buying a car, planning a wedding, or embarking on a large-scale home project.

Parents and Adult Children Tackling Shared Expenses

Sometimes, family members take out loans together to address shared expenses, such as paying off a child’s tuition or medical expenses.💲

Friends in Business Together: When It’s a Smart Move

Business partnerships often require upfront capital. Joint loans provide friends with a way to raise the necessary funds, assuming they’ve built a foundation of trust.

Roommates Tackling Major Home Expenses

If you share a rental or home with a friend or sibling, joint loans can be used for upgrades or expenses, like new appliances or security deposits.

How to Qualify for a Joint Personal Loan

Income Requirements: Double the Earnings, Double the Chances?

Each lender has its own criteria, but with two incomes to consider, joint loan applicants are often viewed more favorably, especially for high loan amounts.

Credit Score Essentials for Joint Applicants

Lenders will review both credit scores, so it’s important for both parties to have a credit score that meets the lender’s requirements to get the best rates.

Employment Verification: Both Need a Solid Income Source

Having steady employment is crucial for both applicants. The more stable and documented the income, the stronger your joint application.

Debt-to-Income Ratio: Why Lenders Love Balanced Finances

An ideal debt-to-income ratio indicates that both applicants are financially sound and capable of managing the additional loan payments.

Finding the Right Lender for Joint Personal Loans

Banks vs. Credit Unions: Which Offers Better Deals?

While traditional banks often offer established programs, credit unions are known for personalized service and flexible rates. Each option has its unique benefits, so comparing rates is essential.

Online Lenders and Peer-to-Peer Options

From SoFi to LendingClub, online lenders offer competitive joint loan options with a streamlined application process. Peer-to-peer lending also provides flexible terms for many borrowers.

Lender Perks: Benefits to Look For with Joint Loans

Consider looking for lenders who offer perks, such as automatic payment discounts, customer service accessibility, and personalized loan guidance.

Avoiding Predatory Lenders: Red Flags to Watch Out For

Beware of high-interest rates, hidden fees, and untrustworthy practices. A reliable lender will be transparent about all terms, costs, and policies.

Comparing Joint Loans with Other Loan Types

Joint Personal Loans vs. Co-Signed Loans: Key Differences

With a co-signed loan, only one person holds ownership, while the other simply serves as a guarantor. Joint loans provide equal ownership for both.

Joint Personal Loans vs. Secured Loans: Which Is Safer?

Secured loans require collateral, while joint personal loans don’t. Each has unique pros and cons based on your financial goals and risk tolerance.

When a Joint Credit Card Is a Better Alternative

For smaller, recurring expenses, a joint credit card may be a practical alternative, especially for partners with shared monthly expenses.

Conclusion: Is a Joint Personal Loan Right for You?

Recap of Key Considerations for Joint Borrowers

Choosing a Joint Personal Loan is a big decision that brings added benefits and responsibilities. Weighing the pros and cons and understanding the legal obligations is crucial for a smooth journey.

Deciding Together: Making the Ultimate Partner Move

When both parties are aligned in their goals, a joint loan can be a powerful tool to achieve financial milestones together.

Final Thoughts: A Smart Way to Build Your Future

With a bit of preparation and communication, joint loans can be the springboard for reaching mutual goals.

People Also Ask

Can You Get a Joint Personal Loan?

Yes, many lenders offer joint personal loans that allow two individuals to apply and share the responsibility for repayment. This type of loan can increase borrowing power and improve chances of approval.

Can Two People Take Out a Personal Loan Together?

Absolutely! Two people can apply together for a personal loan. This is often helpful for couples or business partners looking to share both the debt and the financial benefits.

Is It Better to Get a Joint Personal Loan?

A joint personal loan can be beneficial as it combines two incomes, potentially securing a higher loan amount and better interest rates. However, it also means shared responsibility for repayment, which requires trust and financial alignment.

Can Two People Take Out a Joint Loan?

Yes, two people can take out a joint loan, sharing both the debt obligation and the ability to pay it off. Many lenders see joint loans as lower-risk since they involve two income sources.

Can Two People Go on a Personal Loan?

Yes, two people can be co-applicants on a personal loan. This arrangement can lead to improved loan terms due to the combined creditworthiness and income of both applicants.

Can Two People Be on the Same Loan?

Yes, two individuals can be on the same loan, sharing the benefits and responsibilities. This is common for joint personal loans and mortgage loans, where the debt is sizable.

How Many Personal Loans Are You Allowed?

There is generally no fixed limit on the number of personal loans an individual can have, but lenders will evaluate your debt-to-income ratio before approving multiple loans to ensure you can manage repayment.

Does Wells Fargo Do Joint Personal Loans?

Yes, Wells Fargo allows co-applicants for personal loans, which enables two people to share a loan and potentially qualify for better rates and larger amounts together.

What Is a Relationship Personal Loan?

A relationship personal loan is often a loan offered with special terms, discounts, or benefits based on an established banking relationship with the lender.

How Many People Can Be on a Joint Loan?

Typically, joint loans are limited to two people, but certain lenders may allow additional co-applicants depending on the loan type and purpose.

Is It OK to Have Two Personal Loans?

Yes, it is possible to have more than one personal loan, provided you can afford the repayments and maintain a healthy debt-to-income ratio.

Is Joint Finance Better?

Joint financing can be advantageous as it combines incomes and credit profiles, often resulting in more favorable loan terms. However, it also requires clear communication and shared financial goals.

Can Two People Apply for a Personal Loan Together?

Yes, two people can apply for a personal loan together. This joint application approach can increase approval odds and allow access to a higher loan amount.

Can I Combine Two Personal Loans?

Yes, it is possible to combine multiple personal loans by refinancing or consolidating them into a single loan, often with the goal of simplifying payments and potentially lowering interest rates.

How Much Can a Couple Borrow?

A couple can often borrow more than a single applicant, as combined incomes may allow them to meet higher loan eligibility requirements. The exact amount varies depending on lender policies and creditworthiness.

How to Get Approved for a Joint Loan?

To get approved for a joint loan, ensure both applicants have steady incomes, good credit scores, and a manageable debt-to-income ratio. Providing documentation and applying with a reputable lender also helps.

Is It Better to Get a Joint Loan?

Getting a joint loan can be beneficial if both applicants bring strong financial profiles, potentially improving the loan terms. However, joint loans require mutual responsibility for repayment, which should be carefully considered.

How Much Money Can You Loan Someone?

The amount you can loan someone depends on factors like your lender’s policies and your income. Generally, personal loans can range from a few thousand dollars to $50,000 or more.

Can You Borrow More as a Couple?

Yes, couples can often qualify for higher loan amounts due to their combined income and shared financial responsibility, making joint borrowing an attractive option for major purchases.

Can You Split a Loan Between Two People?

Yes, with a joint loan, repayment can be split between two borrowers. However, both are legally liable for the full loan amount, so missed payments can impact both credit scores.

Can You Put Two Loans Together?

Yes, two loans can often be consolidated into one, particularly through refinancing. Consolidating can simplify monthly payments and sometimes reduce overall interest.