Understanding the Interest Rate on Car Loans can feel like navigating a maze of percentages, numbers, and banking terms designed to confuse us all. Two primary figures demand attention: APR (Annual Percentage Rate) and Interest Rate. They sound similar, often used interchangeably, yet differ significantly. A savvy borrower knows that understanding both can mean the difference between a good deal and an expensive mistake.

APR and Interest Rate: Why All the Fuss?

Why does the finance world insist on keeping things complicated? In essence, the Interest Rate is the cost of borrowing money, whereas the APR includes that cost plus any additional fees. These two metrics define how much you pay, month after month, on your car loan. Knowing their distinct roles can save you money and headache over the loan’s life.

How APR and Interest Rate Affect Car Loans Differently

Here’s the crux: the Interest Rate affects your monthly payment directly. The higher it is, the more you pay each month. Meanwhile, the APR encompasses the broader picture, representing the true cost of the loan by including fees and charges. Together, they affect both your total loan balance and how much you pay each month.

Meet the Contenders: APR vs Interest Rate, Defined

Think of APR as the total package🏎️it includes the Interest Rate and any additional lender fees. Interest Rate, however, is simply the percentage of your principal loan balance that you’ll pay each year. When comparing lenders, focusing on the APR gives a fuller view of the deal.

APR in Action: What’s Included Besides Interest?

The APR isn’t just a number; it’s a collection of costs, from administrative fees to processing charges. Sometimes, it even includes taxes. These extra costs help lenders cover their overheads, but they also inflate the APR, making it look higher than the Interest Rate.

Interest Rate Explained: The Basic Cost of Borrowing

Think of the Interest Rate as the raw fee for using someone else’s money. It’s a straightforward percentage, easy to compare across loans. However, it can be misleading since it doesn’t include the extras that APR covers, meaning it doesn’t fully reflect what you’ll pay.🏎️

APR vs Interest Rate – Why Do Both Exist?

If both measure the cost of a loan, why are both needed? Simple. Interest Rate lets you compare the raw borrowing costs, while APR gives you the real cost of the loan. Lenders provide both, hoping you’ll focus on the lower Interest Rate and overlook a potentially high APR.

APR – More Than Just a Number

APR is often overlooked, yet it offers transparency. By representing the true cost, APR ensures you understand your full loan obligation.

The Hidden Heroes: Fees, Taxes, and Charges in APR

Inside the APR figure lies a breakdown of costs🏎️fees, taxes, and other charges lenders tack on. These elements transform APR from a mere number into a critical figure that reflects what you’re actually paying for the car.

Why APR May Seem Higher but Reflects the Real Deal

A high APR can look daunting, but it’s a truer picture of what you’ll pay. If your Interest Rate is low but your APR high, you’re likely facing numerous fees. Thus, a higher APR isn’t necessarily bad; it’s just more honest.

Common Costs Rolled Into APR on Car Loans

Common fees included in APR are document fees, dealer markups, and any upfront charges. This means APR is like the bundled cable package of loan costs🏎️everything in one place.🏎️

When APR Actually Helps You: Transparency in Costs

Knowing the APR allows you to spot loans that sound cheap but come with hidden costs. In a world where transparency isn’t always a given, APR can be your best friend in revealing the true expense of a car loan.

The Car Loan APR Spectrum: How Low Can It Go?

Car loan APRs can vary dramatically. Excellent credit and a sizable down payment can net you a low APR, sometimes in the single digits, while those with lower credit scores will see much higher APRs. Understanding the spectrum helps you set realistic expectations.🏎️

Interest Rate – The Face Value of Your Loan

The Interest Rate is often the first number you see, but it’s not the full picture. Think of it as the tip of the iceberg🏎️it’s significant, but there’s more below the surface.

Why Interest Rate Isn’t the Whole Story

The Interest Rate determines a big part of your monthly payment, but without considering APR, you’re only seeing part of the cost. That low rate might be tempting, but APR unveils any hidden fees.

How Lenders Decide Your Car Loan Interest Rate

Lenders consider your credit score, income, and car type to set your Interest Rate. A high score typically results in a lower Interest Rate, while a lower score pushes it up, reflecting perceived risk.🏎️

The Good, The Bad, and The Expensive: Interest Rate Ranges

Interest rates range from attractive single digits for top borrowers to steep double digits for those with weaker credit. Comparing rates across lenders can reveal how your unique factors impact the offers you receive.

Why Interest Rates Matter for Your Monthly Payments

The Interest Rate directly influences your monthly obligation. Higher rates equal higher monthly payments, meaning even a small difference can add up over the loan term.🏎️

Interest Rate and Loan Terms: Short vs. Long Debate

Shorter loan terms generally feature lower Interest Rates. A longer term might lower your monthly payments but could also mean paying more in interest overall. It’s a tradeoff worth considering.

Factors That Sway APR and Interest Rates

Both APR and Interest Rate fluctuate based on several factors. Recognizing these can help you secure the best loan possible.🏎️

How Your Credit Score Impacts Both APR and Interest Rate

Credit scores heavily influence APR and Interest Rate. A higher score means lower rates and APRs, as lenders view you as less risky.

The Down Payment Dilemma: How Much to Lower APR?

The larger the down payment, the lower the APR. By reducing the principal, a bigger down payment minimizes the lender’s risk, allowing them to offer a better rate.

Loan Terms and Their Effect on APR and Interest Rate

Longer loan terms usually increase APR as more interest accumulates. Shorter terms may lead to a higher monthly payment but could save you in the long run.🏎️

How New or Used Cars Change Your APR and Interest Rate

New cars typically come with lower Interest Rates and APRs due to their higher value. Used cars, considered riskier assets, often carry higher rates and APRs.

Lender Types – Who Offers the Best APR vs Interest?

Banks, credit unions, and online lenders each offer different APRs and Interest Rates. credit unions often provide the best rates to members, while online lenders can be competitive for those with good credit.

Making APR and Interest Rate Work for You

Knowing how to leverage APR and Interest Rate can help you score the best deal.

How to Compare APR and Interest Rate Smartly

When shopping, look at both APR and Interest Rate. A lower Interest Rate may not be the best deal if the APR is high🏎️always check for hidden fees.

Negotiating APR vs Interest Rate with Confidence

Negotiate with lenders by using your knowledge of APR and Interest Rate. Ask them to clarify any fees contributing to APR and request a reduction if they seem excessive.

Should You Choose APR or Interest Rate as Your Focus?

APR provides a clearer picture, making it a better focus for overall cost, while Interest Rate can help gauge monthly affordability. Ideally, balance both based on your priorities.

APR or Interest Rate: Which One to Prioritize?

Prioritize APR if you want the most accurate cost analysis. If monthly payment size is a concern, however, give Interest Rate more attention.

Conclusion:

Understanding APR vs Interest Rate for the Road Ahead

Understanding the Interest Rate on Car Loans and APR empowers you to make informed financial decisions.

Wrapping Up: How to Use APR and Interest Rates to Save

Review both APR and Interest Rate on offers to determine total costs. Savvy borrowers can use this knowledge to choose the most affordable option.

Avoiding Pitfalls and Securing the Best Car Loan Deal

By analyzing APR and Interest Rate together, you can avoid common loan pitfalls, saving money over the life of your loan. Use this guide to navigate the numbers and drive away with a smarter car loan.

People Also Ask

Is APR the Same as Interest Rate for Cars?

No, APR and Interest Rate are not the same when it comes to car loans. The Interest Rate refers specifically to the cost of borrowing the principal amount, while APR includes the Interest Rate plus any additional fees and charges associated with the loan. This makes APR a more comprehensive measure of the total cost of borrowing.

Should I Go by APR or Interest Rate?

When comparing car loans, it’s advisable to focus on APR. While the Interest Rate gives you a glimpse of the basic borrowing cost, APR provides a clearer picture by factoring in all associated fees. By prioritizing APR, you can better assess the total cost and avoid any surprises.

What Is a Good APR Rate for a Car?

A good APR for a car loan typically ranges from around 3% to 6% for borrowers with excellent credit. However, rates can vary based on credit score, loan term, and whether the car is new or used. Always shop around to find competitive offers.

What Does 4.9% APR Mean?

An APR of 4.9% means that, over the course of a year, you will pay 4.9% of the principal amount in interest and fees combined. If you borrow $20,000, a 4.9% APR means that you would owe approximately $980 in interest and fees in the first year, not accounting for the principal payment.

Why Is APR Higher Than Rate?

APR can be higher than the Interest Rate because it incorporates various fees and charges, such as loan processing fees, closing costs, and other lender fees. This gives you a better understanding of the true cost of the loan, as the Interest Rate alone does not account for these additional costs.

Does APR Matter if I Pay on Time?

Yes, APR matters regardless of whether you pay on time. Paying on time will help you avoid late fees and penalties, but the APR still determines how much interest you will pay over the life of the loan. A lower APR will always result in lower overall costs.

Is APR Good or Bad?

APR itself isn’t inherently good or bad; it simply reflects the cost of borrowing. A lower APR is generally favorable, as it means lower overall costs. However, a high APR can be a warning sign of potential pitfalls, such as hidden fees or a riskier loan.

Who Has the Best APR for Car Loans?

Banks, credit unions, and online lenders all compete to offer the best APR for car loans. Credit unions often provide lower rates to their members. It’s best to shop around and compare offers from multiple lenders to find the most competitive APR.

What Is a Good APR for a Loan?

A good APR for a loan varies based on your creditworthiness, but generally, a rate under 10% is considered good for personal loans. For those with excellent credit, rates can drop below 5%. Always compare offers and look for the most favorable terms.

Does 0 APR Mean No Interest?

Yes, a 0% APR means you won’t pay any interest on the loan, provided you meet the terms and conditions. However, be cautious, as these offers may have strict requirements or hidden fees that could offset the benefits of no interest.

Is APR the Effective Interest Rate?

Yes, APR is often considered the effective interest rate as it reflects the total cost of borrowing, including interest and fees. This makes it a more accurate representation of what you’ll pay compared to the nominal Interest Rate.

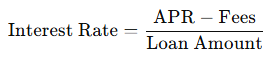

How to Calculate Interest Rate from APR?

To calculate the Interest Rate from APR, you can use the formula:

However, this is more complicated since APR includes fees and other charges. A simpler approach is to compare loans and their APR directly.

How Does APR Work on a Car Loan?

APR on a car loan represents the total cost of borrowing expressed as a yearly percentage. It includes both the Interest Rate and any additional fees. When you take out a loan, the lender will calculate your monthly payments based on your APR, ensuring you understand the total cost over the life of the loan.

Is APR Monthly or Yearly?

APR is expressed as a yearly percentage. It indicates the total cost of borrowing over one year, including interest and any applicable fees. However, the monthly payments are calculated based on this annual rate.

What’s the Difference Between APR and Fixed Interest Rate?

The key difference is that APR includes all associated costs of borrowing, while a fixed Interest Rate refers solely to the interest charged on the principal amount. A fixed Interest Rate remains constant throughout the loan term, whereas APR can fluctuate based on additional fees.

Why Is My APR Lower Than My Interest Rate?

This situation can occur if your Interest Rate is not reflecting the true cost of the loan due to high fees or other charges that are included in the APR. It’s essential to evaluate both figures to understand the overall cost of borrowing accurately.

Can APR Be Higher Than Interest Rate?

Yes, APR can be higher than the Interest Rate because it encompasses the Interest Rate plus additional fees and charges. This discrepancy is common, especially in loans with high fees, making APR a more reliable measure of the total borrowing cost.