Introduction: Mortgages and the Quest for Sanity

Embarking on the journey of calculating a mortgage loan can feel like stepping into a labyrinth of numbers and jargon. But fear not! With a dash of humor and a sprinkle of analytical insight, you can navigate this financial maze with your sanity intact. Understanding your mortgage doesn’t have to be a horror story; it can be an empowering process that demystifies the path to homeownership.

Why Calculating a Mortgage Loan Doesn’t Have to Be a Nightmare

Calculating a mortgage might seem like trying to decode ancient hieroglyphs, but it doesn’t have to be a nightmare. By breaking down the process into manageable pieces, you can transform what seems like a monstrous task into a mere puzzle. No need to fear the spreadsheets and calculators embrace them as your new best friends.

The Importance of Knowing Your Numbers

The crux of any mortgage is understanding the numbers that drive it. Knowing your loan amount, interest rate, and term length is crucial because these figures dictate how much you’ll pay each month and overall. This knowledge empowers you to make informed decisions, avoid surprises, and keep your budget in check.

Understanding the Basics of Mortgage Calculations

Breaking Down Mortgage Terminology: From Amortization to Zoning

Mortgage calculations are steeped in specialized terminology. Let’s start with amortization the process by which your loan balance decreases over time through regular payments. Then, there’s the principal, the original loan amount; the interest, the cost of borrowing; and terms like escrow, which involves saving funds for property taxes and insurance. Understanding these terms is like having a map in your financial journey.

Fixed vs. Adjustable Rates: What’s the Difference and Why It Matters

When choosing between a fixed-rate and an adjustable-rate mortgage (ARM), you’re deciding between stability and flexibility. A fixed-rate mortgage provides predictability, with consistent payments throughout the loan term. On the other hand, an ARM may start with a lower rate but can fluctuate, potentially altering your payment amounts. Deciding which suits your financial style depends on your risk tolerance and long-term plans.

The Key Components of a Mortgage Calculation

Principal, Interest, Taxes, and Insurance: The Fabulous Four

Your mortgage payment is a cocktail of four main ingredients: principal, interest, taxes, and insurance (PITI). The principal is the loan amount, interest is the cost of borrowing, taxes are your property taxes, and insurance covers homeowners and possibly private mortgage insurance (PMI). Each component plays a role in your total monthly payment, and understanding them helps in budgeting accurately.

How the Loan Term Affects Your Monthly Payment

The term of your loan whether 15, 20, or 30 years affects both your monthly payment and the total amount paid over the life of the loan. A shorter term generally means higher monthly payments but less total interest paid. Conversely, a longer term spreads out payments and lowers the monthly cost but increases the total interest. Balancing these factors is key to finding a loan term that fits your financial goals.

The Formula for Success: Mortgage Calculation Made Simple

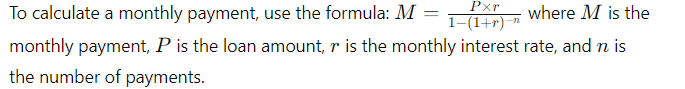

The Classic Mortgage Calculation Formula Unveiled

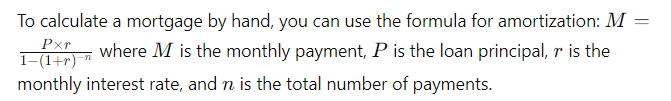

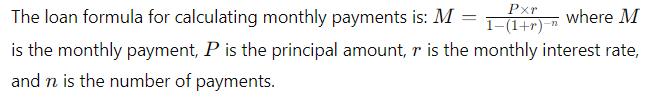

At the heart of mortgage calculations is the formula used to determine your monthly payment: M = P[r(1 + r)^n] / [(1 + r)^n – 1]. Here, M is the monthly payment, P is the principal loan amount, r is the monthly interest rate, and n is the number of payments. It sounds complex, but breaking it down into its parts reveals a methodical approach to calculating your mortgage payment.

How to Use a Mortgage Calculator Without Losing Your Mind

Mortgage calculators are handy tools that simplify the process. ! You get your monthly payment. It’s like having a financial wizard at your fingertips. Just be sure to double-check your inputs and understand that calculators provide estimates; your actual payment may vary slightly.

DIY Mortgage Calculation: A Step-by-Step Guide

Step 1: Gathering Essential Information (No, You Don’t Need to Sacrifice Your Firstborn)

Before diving into calculations, gather essential details: your loan amount, interest rate, and loan term. It’s also helpful to have your property tax and insurance estimates. No need for blood sacrifices just accurate data will suffice.

Step 2: Calculating Your Monthly Payment: The Easy Way

Using the gathered information, you can plug the numbers into the mortgage formula or a calculator. For a more hands-on approach, use the formula to manually compute your monthly payment. This method offers a deeper understanding of how each component affects your payment.

Step 3: Understanding Amortization Schedules and Their Mysteries

Amortization schedules show how much of each payment goes toward principal and interest. In the early years, most of your payment covers interest, but as time progresses, a larger portion goes toward the principal. Familiarizing yourself with this schedule helps in understanding how your loan balance decreases over time.

Advanced Mortgage Calculation Techniques

The Impact of Extra Payments: How a Little Can Go a Long Way

Making extra payments on your mortgage can significantly reduce the total interest paid and shorten your loan term. Even small additional payments can make a big difference, so consider rounding up your payments or making occasional lump sums to accelerate your mortgage payoff.

How to Calculate Early Payoff and Save Thousands

To calculate early payoff, determine how additional payments impact your loan term and interest. Online calculators can estimate how extra payments will shorten your term and reduce interest costs. This strategy can save you thousands over the life of the loan and free you from debt sooner.

Common Pitfalls and How to Avoid Them

Avoiding Mistakes That Make Mortgage Calculations Feel Like Rocket Science

Common mistakes in mortgage calculations include incorrect interest rate entries and misunderstanding the impact of different loan terms. Double-check your inputs and understand the calculations to avoid these pitfalls. With a bit of diligence, you can sidestep errors that complicate your mortgage journey.

Why Overlooking Fees Can Lead to a Financial Headache

Fees, such as closing costs and loan origination fees, can significantly impact the overall cost of your mortgage. Failing to account for these fees can lead to financial surprises. Always factor in these costs when calculating your mortgage to avoid unexpected expenses.

Tools and Resources for Mortgage Calculation

The Best Mortgage Calculators: Your New Best Friends

Mortgage calculators are invaluable tools for estimating your payments. Look for ones that offer detailed breakdowns and allow you to adjust variables. These calculators help you visualize different scenarios and make informed decisions about your mortgage.

Apps and Websites That Simplify Mortgage Math

In addition to traditional calculators, numerous apps and websites streamline mortgage calculations. These digital tools often include features like real-time updates and financial insights, making mortgage math less of a chore and more of a breeze.

Seeking Professional Help: When to Call in the Experts

When Is It Time to Consult a Mortgage Advisor?

Consult a mortgage advisor if your financial situation is complex or if you need tailored advice. Advisors can provide insights into different loan options and help you navigate the mortgage process with expertise. Don’t hesitate to seek professional guidance to ensure you’re making the best decisions for your financial future.

How to Find a Reliable Mortgage Professional

Finding a reliable mortgage professional involves researching and comparing different advisors. Look for credentials, client reviews, and recommendations from trusted sources. A good advisor will offer transparent advice, answer your questions, and guide you through the mortgage process effectively.

Maintaining Your Sanity During the Mortgage Process

Staying Cool When Interest Rates Fluctuate

Interest rates can be volatile, but maintaining composure is crucial. Monitor trends and consult with your mortgage advisor to understand how fluctuations may impact your loan. Keeping a level head helps you make rational decisions and avoid stress.

How to Handle Mortgage Calculations Without Losing Sleep

Handling mortgage calculations doesn’t have to keep you awake at night. Break down the process into manageable steps, use reliable tools, and seek help if needed. Staying organized and informed helps you tackle mortgage calculations with confidence and ease.

Final Thoughts: Calculating Mortgages Like a Pro

Recap of Key Points: Keeping It Simple and Stress-Free

To recap, understanding mortgage calculations involves knowing the key components, using the right tools, and avoiding common mistakes. Simplify the process by breaking it down into steps and seeking professional help if needed. By mastering the basics, you can navigate the mortgage landscape with ease.

The Road Ahead: Applying What You’ve Learned to Your Mortgage Journey

Armed with your new knowledge, you’re ready to tackle your mortgage journey confidently. Apply what you’ve learned to make informed decisions, manage your finances effectively, and achieve your homeownership goals with sanity intact.

Frequently Asked Questions (FAQs)

How do banks calculate mortgage loan?

Banks use a formula based on the loan amount, interest rate, and loan term to calculate mortgage payments. They often use amortization schedules to determine how much of each payment goes toward interest and principal.

How do you calculate mortgage by hand?

Is there a mortgage formula in Excel?

How is mortgage interest calculated?

Mortgage interest is calculated based on the loan amount and the interest rate. It’s typically compounded monthly, so the interest for each period is calculated on the remaining balance.

How is the mortgage score calculated?

The mortgage score, or credit score, is calculated based on factors like payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

What are the factors of mortgage calculation?

Factors include the loan amount, interest rate, loan term, payment frequency, and amortization schedule.

How to calculate mortgage payment interest and principal?

To calculate the interest and principal portions of a mortgage payment, use an amortization schedule. Each payment is split between interest and principal based on the remaining loan balance.

How is a mortgage paid?

A mortgage is paid through regular monthly payments that cover both interest and principal. Over time, the principal balance decreases, and the amount going toward interest reduces.

How is bank mortgage calculated?

Bank mortgages are calculated using an amortization formula that considers the loan amount, interest rate, and term to determine the monthly payments.

How to calculate monthly payment?

How to calculate interest rate?